Hot or Not, Stock Market Edition: 10/02/2025

Happy Thursday! Here’s what’s hot and what’s not today:

- Hot: Broadcom (AVGO) got 10 Strong Buy ratings last month; Meta Platforms (META) could be a great dip buy this week

- Not: Unpacking Alibaba’s (BABA) mixed messages; Shopify (SHOP) gets a downgrade from our quant ratings system

P.S. For more stocks making moves, check out our Zen Ratings Upgrades & Downgrades screener.

_________________

Goldman Sachs: "More Than 1,600 New Millionaires Quietly Being Anointed Due to Breakthrough Technology" And that's only the beginning... Jeff Bezos, Mark Zuckerberg, Bill Gates, Jensen Huang, and Elon Musk are all quietly investing millions in a secret revolutionary technology. You've never heard anything like this before... Click here to watch this special investigative documentary.*

*Our sponsors help keep this content free

_________________

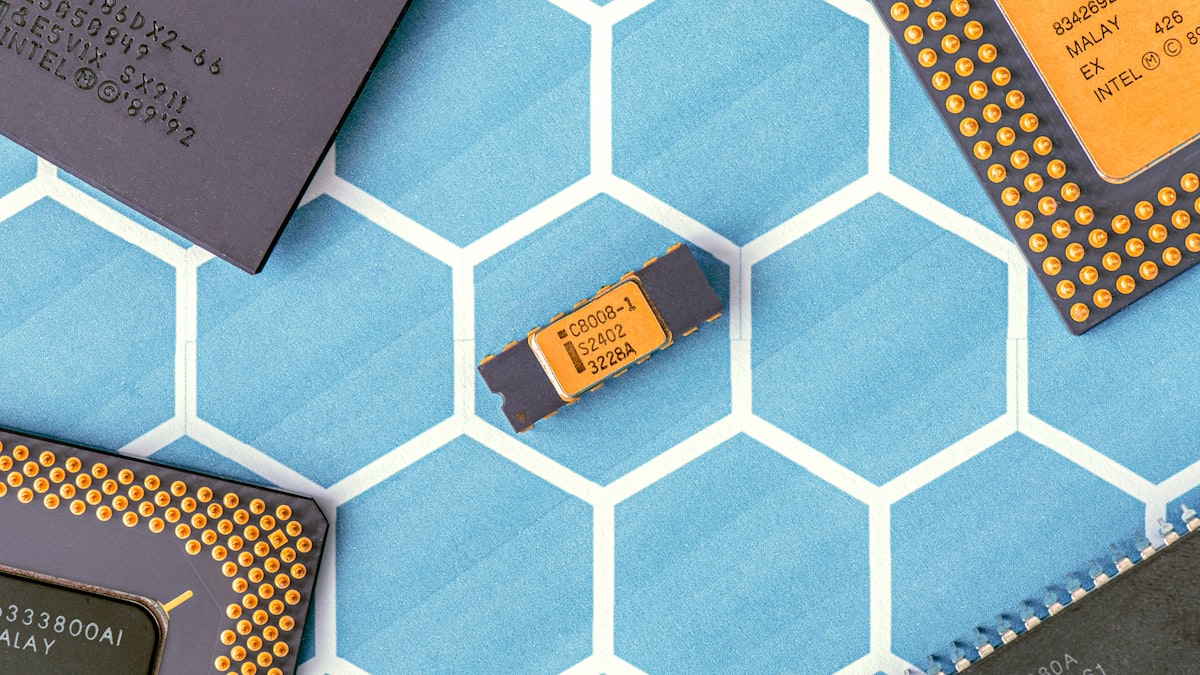

🔥 HOT: Broadcom (AVGO) is sizzling at the intersection of AI demand and semiconductor supply chain dominance. Proof? Broadcom just strengthened its growth story with a strong Q3 earnings beat — resulting in 10 Strong Buy ratings in the past month alone. The stock boasts a Zen Rating of B, ranking in the 85th percentile of stocks we track, with an enviable Momentum Grade of B, and a robust Financials Grade of B. Currently trading in the $330s, AVGO’s year-to-date price trajectory keeps climbing — but based on the fundamentals, plus Broadcom’s strategic positioning and consistent financial performance amid the AI boom, it could continue to be an excellent investment for investors seeking resilient tech exposure.

🥶 NOT: It’s hard to know what to make of Alibaba (BABA). Currently trading in the $180s, the stock has come down a lot since its $300+ highs in 2020 — but could things be turning around? It’s gained 10% in the past week — is it on the precipice of a big run thanks to growing cloud revenue from AI, as Jeffries analyst Thomas Chong believes? Or are the pros overestimating BABA’s cloud opportunity, as outlets like Seeking Alpha suggest? Rather than speculate, let’s look at what the cold, hard data tells us. Looking at the Zen Rating, BABA earns a C (Hold) rating, with the Component Grades that shape the overall rating revealing several red flags. Despite one “good” grade — a B for Momentum — the stock has a pretty dismal report card. It earns an F in Growth, indicating its growth prospects are dismal, and Ds for both Sentiment and Safety. Considering this, plus the persistent macro risks and skepticism plaguing Chinese tech, we’re watching with caution rather than jumping on board with the recent rally.

🔥 HOT: Meta Platforms (META) is flexing its AI muscles. Its recent $14 billion deal with CoreWeave has sent a wave of excitement across the tech sector about next-gen AI infrastructure. Funny enough, CoreWeave (CRWV), which we currently rate a D (Sell), saw some noticeable price movement, while META’s price dropped following the news. But when you move past the hype, we believe META has the makings of a stronger investment. With a Zen Rating of B, it’s in the 91st percentile of stocks we track. The underlying Component Grades are likewise strong — it earns an A for both Financials and Sentiment, signaling robust fundamentals and acknowledging positive investor buzz. Right now, it appears META is delivering the goods — and with analysts forecasting as much as 47% potential upside in the next year and its strong ranking in our quant ratings system, it’s definitely one to watch.

A note from our sponsors...

Buffett's $114 Secret In 1943, a teenage Warren Buffett put $114 into a special type of account called "The 29% Account." Today, that single, $114 investment would be worth over $15 million. Your bank never told you about this. Click Here to See How It Works🥶 NOT: Shopify (SHOP) Shopify has been surfing the swell of the AI revolution, with partnerships with OpenAI and broader integration with ChatGPT playing a role in the stock’s impressive 80%+ gains in the past year. But will it last? According to our Zen Ratings system, which recently downgraded the stock to a C (Hold), there may be a reason for pause. For one, SHOP currently ranks roughly in the 50th percentile of stocks we track overall, indicating there are literally thousands of stocks that have stronger fundamentals. Digging into the Component Grades that play into the Hold rating, despite an A for Momentum and B for Financials, it suffers from a D Value Grade, suggesting the stock looks pricey relative to its fundamentals. Despite its role as a platform powerhouse in the ecommerce world, valuation concerns are surfacing as SHOP trades near all-time highs. Our take? Wait for a more compelling entry point.

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.