5 stocks to Watch: Week of 2/2/2026

Happy Groundhog Day, to all those celebrating!

Happy Groundhog Day, to all those celebrating!

Happy…

Whoa, before we get stuck in an inescapable repeat cycle, let’s pivot to the stocks. We’ve got:

- Indivior PLC (INDV) could see accelerated growth in the near term

- Micron Technology (MU) continues to slay (and is still Strong Buy rated)

- Hubbell (HUBB): Analyst-backed electrical leader ahead of earnings

- Semtech (NSMTC): High-momentum semiconductor comeback with elite analyst support

- Elanco Animal Health (ELAN) proves how much people love their pets

Let's get to it.

A note from our sponsors...

10 Best Stocks to Own in 2026 Enter your email address below and we'll send you MarketBeat's list of the 10 best stocks to own in 2026 and why they should be in your portfolio. You will also receive our free daily email newsletter with the latest buy and sell recommendations from Wall Street's top analysts. Get your copy now here1- Indivior PLC (NASDAQ: INDV)

This company develops and sells buprenorphine-based prescription drugs for treating opioid dependence and co-occurring disorders. The company recently completed its redomiciliation to the United States and announced strong full-year 2026 guidance, positioning itself for accelerated growth.

Zen Rating: A (Strong Buy) — see full analysis

Recent Price: $33.58 — get current quote

Max 1-year forecast: $48.00

Why we're watching:

- Analyst support: INDV enjoys unanimous bullish consensus with 1 Strong Buy rating and 2 Buy ratings from 3 analysts covering the stock. See the ratings

- Piper Sandler's David Amsellem (a top 6% rated analyst) recently reiterated a Strong Buy rating with a $41 price target following Q3 earnings that beat consensus, with SUBLOCADE worldwide sales guidance raised to $825M-$845M, implying approximately 10% annual growth.

- HC Wainwright maintained coverage with a $48 price target, the highest among analysts, suggesting over 45% upside potential. The firm highlighted the company's progress in Phase I of the Indivior Action Agenda and expected $150 million in annual operating expense savings beginning in 2026.

- Industry ranking context: INDV is currently the 2nd highest-rated stock in the Pharmaceutical industry, which has an Industry Rating of B.

- Zen Rating highlights: Strong Buy (A) stocks average +32.52%/yr — based on the aforementioned price targets, INDV could potentially scorch even these impressive averages.

- Component Grades: The company showcases balanced performance with Value (B), Growth (B), Momentum (B), and standout Sentiment (A) grades, reflecting strong market confidence in the turnaround strategy and commercial execution. (See all 7 Zen Component Grades here)

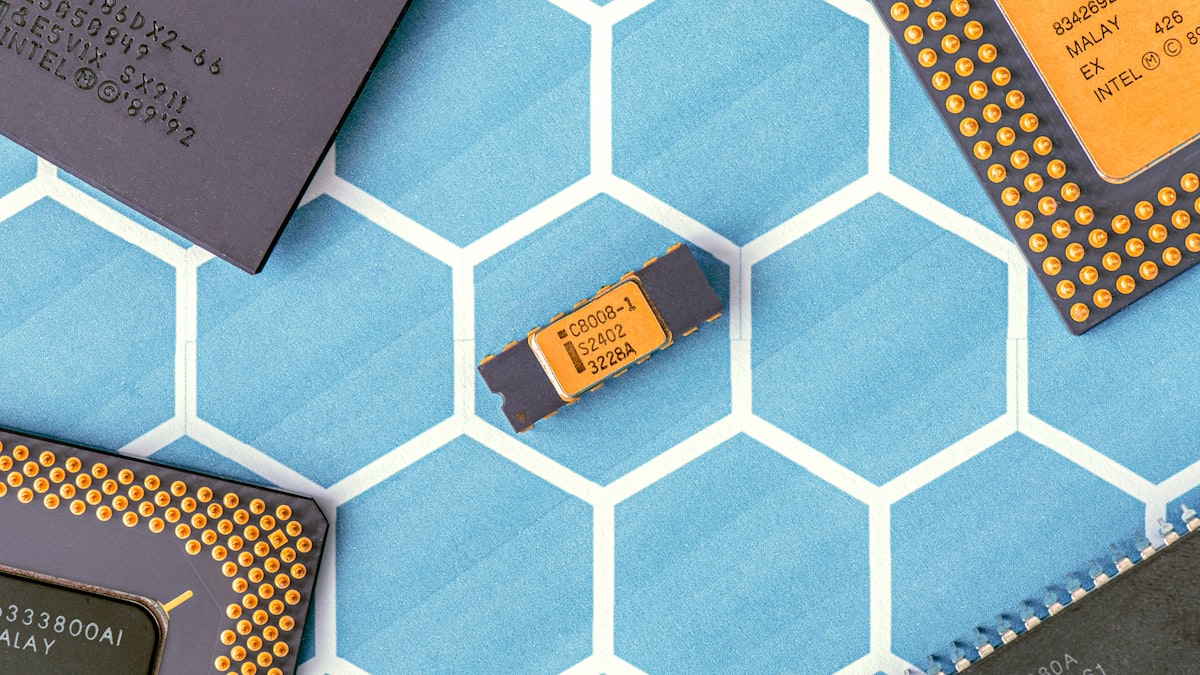

2- Semtech (NASDAQ: SMTC)

Currently ranked #2 in the Semiconductor industry with a B rating, the company is attracting significant attention from elite analysts following its impressive turnaround from a 52-week low of $24.05 to its current price near all-time highs.

Zen Rating: A (Strong Buy) — see full analysis

Recent Price: $80.80 — get current quote

Max 1-year forecast: $95.00

Why we're watching:

- Analyst support: Coverage from 14 analysts shows overwhelming confidence with 8 Strong Buy ratings, 5 Buy ratings, and only 1 Hold rating, establishing a Strong Buy consensus. See the ratings

- Piper Sandler's Harsh Kumar (a top 1% rated analyst) recently reiterated his Strong Buy rating with a $95 price target, emphasizing the growth trajectory of Semtech and its alignment with emerging market demands following the company's recent advancements in technology.

- Morgan Stanley researcher Joseph Moore (a top 1% rated analyst) maintains a Hold rating with a $67 price target, acknowledging that while he sees potential pitfalls in the current market climate, he recognizes long-term value in the company's fundamentals.

- Industry ranking context: SMTC is currently the 2nd highest-rated stock in the Semiconductor industry, which has an Industry Rating of B.

- Zen Rating highlights: Strong Buy (A) stocks average +32.52%/yr — the stock ranks in the top 5% of all of the 4000+ stocks we track.

- Component Grades: Semtech shows balanced performance across components we track, with strong Bs for Financials, Momentum, Safety, and from our proprietary AI factor. See all 7 Zen Component Grades here

A note from our sponsors...

The 10 Best AI Stocks to Own NOW-Yours FREE If you've been following the AI revolution, there's a chance you can guess who's #1 on my brand new list of the best AI stocks to own (if you are lucky, you may even own some shares of this powerhouse already). But I doubt you can guess who's #3 on the list. (HINT: It delivers a technology that's critical to the AI revolution and will soon be embedded in countless consumer products.) Learn the names of all 10 stocks here. FREE.3- Micron Technology (NASDAQ: MU)

This repeat Strong Buy pick specializes in memory and storage products worldwide. The company is capitalizing on extraordinary AI infrastructure demand, with analysts highlighting the shift from spot pricing to sustainable earnings-based valuations.

Zen Rating: A (Strong Buy) — see full analysis

Recent Price: $399.65 — get current quote

Max 1-year forecast: $500.00

Why we're watching:

- Significant upside potential: Our Zen Investor Editor in Chief, Steve Reitmeister, believes that stocks like MU could be the next beneficiaries of the AI revolution. Watch this video to find out why.

- Analyst support: MU enjoys overwhelming bullish sentiment with 16 Strong Buy ratings, 7 Buy ratings, and just 1 Hold rating from 24 analysts covering the stock. See the ratings

- TD Cowen's Krish Sankar (a top 6% rated analyst) recently maintained a Strong Buy rating with a $450 price target, reflecting confidence in the memory super-cycle driven by AI.

- Rosenblatt researcher Kevin Cassidy (a top 1% rated analyst) maintained a Strong Buy rating with a $500 price target, the highest on Wall Street (25% upside potential!) highlighting the company's leadership position in AI memory solutions.

- Wells Fargo's Aaron Rakers (a top 1% rated analyst) maintained a Strong Buy rating with a $410 price target following strong industry demand indicators.

- Citigroup analyst Christopher Danely (a top 2% rated analyst) maintained his Strong Buy rating with a $385 price target, emphasizing the company's strategic positioning in high-bandwidth memory for AI applications.

- Industry ranking context: MU is currently the 1st highest-rated stock in the Semiconductor industry, which has an Industry Rating of B, demonstrating clear sector leadership.

- Zen Rating highlights: Strong Buy (A) stocks average +32.52%/yr. MU is positioned as a cornerstone AI infrastructure play. What’s not to like?

- Component Grades: Micron exhibits impressive balance across key metrics with Value (B), Growth (B), Momentum (A), Sentiment (B), and Financials (A) grades. (See all 7 Zen Component Grades here)

4- Hubbell (NYSE: HUBB)

This industrial and utility giant is turning heads in advance of its upcoming earnings call, with the company drawing attention from top-tier analysts ahead of its fourth-quarter results, positioning itself as a leader in the electrical equipment sector.

Zen Rating: A (Strong Buy) — see full analysis

Recent Price: $486.54 — get current quote

Max 1-year forecast: $575.00

Why we're watching:

- Analyst support: Coverage from 7 analysts includes 2 Strong Buy ratings, 2 Buy ratings, and 3 Hold ratings, reflecting a Buy consensus. See the ratings

- Barclays researcher Julian Mitchell (a top 2% rated analyst) recently maintained his Hold rating with a $465 price target, noting that while Hubbell has solid fundamentals, current valuation makes it a hold as he foresees limited upside potential in the short term.

- Mizuho's Brett Linzey (a top 8% rated analyst) maintains a Buy rating with a $500 price target, emphasizing that Hubbell's diversification and product innovation place it well in the market, making a strong case for long-term growth.

- Industry ranking context: HUBB is currently the 7th highest-rated stock in the Electrical Equipment & Part industry, which has an Industry Rating of C.

- Zen Rating highlights: HUBB ranks in the top tier of stocks we track; Strong Buy (A) stocks average +32.52%/yr.

- Component Grades: The company demonstrates particular strength in Financials with an A grade, supported by a robust 17% profit margin and solid balance sheet metrics, while maintaining B grades in both Growth and Safety. See all 7 Zen Component Grades here

5- Elanco Animal Health (NYSE: ELAN)

This animal health innovator recently received USDA approval for Befrena™, a new anti-IL31 monoclonal antibody injection targeting canine allergic and atopic dermatitis, and will report fourth quarter and full year 2025 results on February 25, 2026.

Zen Rating: A (Strong Buy) — see full analysis

Recent Price: $24.27 — get current quote

Max 1-year forecast: $30.00

Why we're watching:

- Analyst support: Overwhelming bullish consensus with 6 Strong Buy ratings and 1 Hold rating among 7 analysts we track, reflecting exceptional confidence in the company's innovation-led growth model. See the ratings

- Piper Sandler's David Westenberg (a top 5% rated analyst) recently upgraded to Strong Buy with a $30.00 price target, citing strong expected earnings growth and the company's strategic initiatives gaining traction.

- Morgan Stanley's Erin Wright (a top 6% rated analyst) maintains a Hold rating with a $22.00 price target, taking a cautious stance due to market uncertainties despite the company's solid fundamentals.

- JP Morgan's Chris Schott (a top 13% rated analyst) upgraded to Strong Buy with a $24.00 price target, noting that revised estimates reflect robust growth potential with innovations in the pipeline showing promise.

- Industry ranking context: ELAN is currently the 9th highest-rated stock out of 57 in the Pharmaceutical industry, which has an Industry Rating of B.

- Zen Rating highlights: Strong Buy (A) stocks average +32.52%/yr — putting ELAN in a class of stocks poised for potential exceptional returns.

- Component Grades: Growth earns an exceptional A grade, powered by extraordinary projected earnings growth of 168.71% and earnings per share forecast to jump from $0.07 currently to $1.05 in one year, representing +1,406.29% growth. (See all 7 Zen Component Grades here)

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.