5 Stocks to Watch: Week of 12/22/2025

Next trading week will be short, but these high-potential picks will help ensure it’s mighty:

- Jazz Pharmaceuticals (JAZZ) gains momentum amid pipeline advances

- Flowserve (FLS) sets the stage for clean growth ahead

- Micron Technology (MU): Better than NVDA?

- Ciena (CIEN) emerges as a prime AI pick

- Tapestry (TPR) is picking up speed (again!)

P.S. Miss last week's picks? Get them here.

1- Tapestry (NYSE: TPR)

Tapestry is up 56% since its addition to the Zen Investor portfolio … The move may not be over. The stock’s gaining serious momentum as Coach’s North America sales surge, driving market-share wins and upbeat estimate revisions heading into the key holiday season.

Zen Rating: Buy (B) — see full analysis

Recent Price: $124.56 — get current quote

Max 1-year forecast: $148.00

Why we're watching:

- Analyst support: TPR commands impressive Wall Street backing with 8 Strong Buy, 4 Buy, and only 2 Hold ratings among the 14 analysts we track covering the luxury retailer. See the ratings

- JP Morgan's Matthew Boss (top 9%) maintains a Strong Buy rating with the Street-high $148 price target, representing 20% upside potential from current levels.

- Wells Fargo analyst Ike Boruchow (top 6%) maintained his Strong Buy rating with a $125 price target following the company's strong operational performance.

- Industry ranking context: TPR is currently the 4th highest-rated stock in the Luxury industry, which has an Industry Rating of A.

- Zen Rating highlights: Buy (B) stocks are no slouch — they have historically averaged +19.88%/yr — TPR showcases exceptional profitability with return on equity of 361%, far exceeding both its industry and the broader market averages.

- Component Grades: The company earns an A grade in Financials with a 16.1% profit margin, demonstrating strong operational efficiency and pricing power in the competitive luxury market. See all 7 Zen Component Grades here

2- Ciena (NYSE: CIEN)

Ciena Corporation just delivered a blowout Q4 and is emerging as a prime beneficiary of AI-driven network upgrades, with analysts piling in behind its accelerating momentum.

Zen Rating: Strong Buy (A) — see full analysis

Recent Price: $214.37 — get current quote

Max 1-year forecast: $305.00

Why we're watching:

- Analyst support: Right now, CIEN enjoys 7 Strong Buy, 1 Buy, and 4 Hold ratings among the analysts we track covering the stock. See the ratings

- Citigroup analyst Atif Malik (a top 1% rated analyst) recently maintained his Strong Buy rating with a $280 price target following robust earnings. The analyst cited strong fundamentals and attractive valuation which justifies the rating, highlighting strong demand for products and market expansion opportunities.

- Industry ranking context: CIEN is currently the 8th highest-rated stock out of 49 in the Communication Equipment industry, which has an Industry Rating of B.

- Zen Rating highlights: With its Strong Buy (A) rating, CIEN is in a class of stocks that have historically trounced the S&P with +32.52% average annual returns. CIEN demonstrates exceptional growth potential with earnings forecast to surge 193% over the next year as AI infrastructure investments accelerate.

- Component Grades: The stock earns top marks with an A grade in both Growth and Artificial Intelligence components, reflecting its strategic positioning in high-growth technology sectors. See all 7 Zen Component Grades here

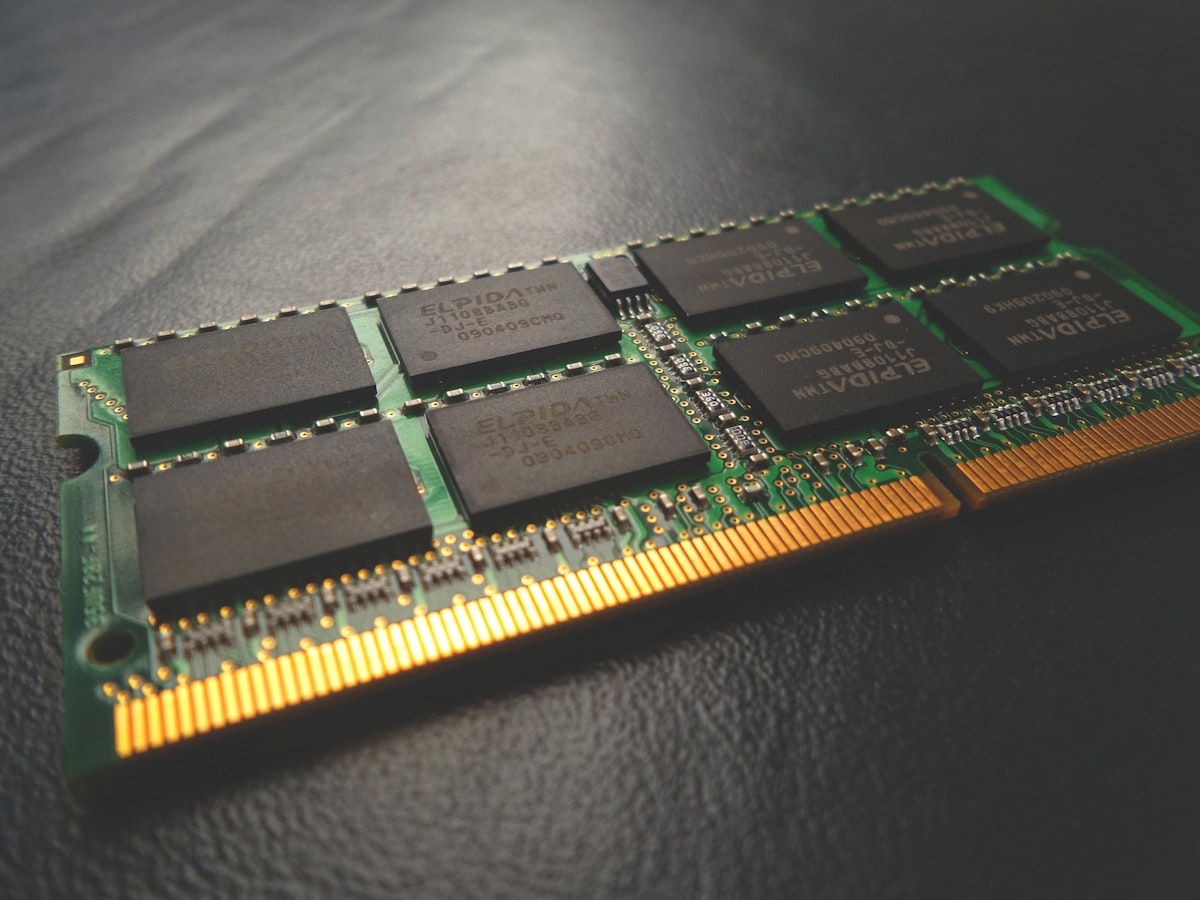

3- Micron Technology Inc (NASDAQ: MU)

Our latest Stock of the Week is heading into Q1 earnings with powerful momentum, as surging AI-driven demand for high-bandwidth memory signals a fresh upcycle in the chip industry.

Zen Rating: Strong Buy (A) — see full analysis

Recent Price: $245.75 — get current quote

Max 1-year forecast: $338.00

Why we're watching:

- Analyst support: The memory leader commands exceptional Wall Street conviction among the analysts we track. It has 16 Strong Buy, 8 Buy, and only 2 Hold ratings among 26 analysts covering the stock. See the ratings

- For example, Stifel Nicolaus analyst Brian Chin (top 5%) recently maintained a Strong Buy rating with a $300 price target, representing 24% upside potential from current levels.

- According to Zen Investor Editor in Chief Steve Reitmeister, who recently spotlighted MU as his Stock of the Week, Micron (MU) offers leveraged exposure to the AI boom at a far cheaper valuation than Nvidia, with explosive earnings growth expected and a fraction of NVDA’s multiple.

- Industry ranking context: MU ranks #1 in the Semiconductor industry, which has an Industry Rating of C.

- Zen Rating highlights: MU earns the highest Zen Rating possible — A (Strong Buy). Stocks in this tier have historically delivered 32.52% annual returns.

- Component Grades: The stock earns strong marks across key factors including an A grade in Momentum, B grades in Value, Growth, and Safety, positioning it as a balanced high-quality semiconductor play. See all 7 Zen Component Grades here

4- Flowserve Corp (NYSE: FLS)

Flowserve just cleared two major overhangs—acquiring Greenray Turbine Solutions and exiting legacy asbestos liabilities—setting the stage for faster, cleaner growth ahead.

Zen Rating: A (Strong Buy) — see full analysis

Recent Price: $69.20 — get current quote

Max 1-year forecast: $85.00

Why we're watching:

- Analyst support: Flowserve enjoys robust analyst backing with 5 Strong Buy, 1 Buy, and 2 Hold ratings among 8 analysts we track providing coverage. See the ratings

- For example, Citigroup's Andy Kaplowitz (a top 1% rated analyst) recently maintained a Strong Buy rating with an $82 price target, citing a bullish long-term view supported by strong fundamentals and strategic initiatives with market adaptability.

- Stifel Nicolaus analyst Nathan Jones (top 2%) maintained a Strong Buy rating with a $66 price target, though cautious about uncertain market conditions while monitoring volatile factors that could impact forecasts.

- Industry ranking context: Flowserve is currently the 2nd highest-rated stock of 70 companies in the Specialty Industrial Machinery industry, which has an Industry Rating of A.

- Zen Rating highlights: FLS is an A-rated (Strong Buy) stock, meaning it’s in the top 5% of the 4600+ tickers we track based on a rigorous review of 115 factors proven to drive stock growth.

- Component Grades: Flowserve demonstrates solid fundamentals with a B in Value, B in Sentiment, B in Safety, B in Financials, balanced by a C in Growth and C in Momentum. See all 7 Zen Component Grades here

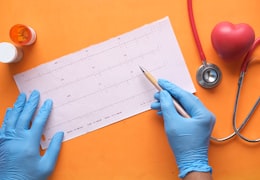

5- Jazz Pharmaceuticals (NASDAQ: JAZZ)

Jazz Pharmaceuticals is gaining momentum as key pipeline advances and upcoming pivotal data for its cancer therapy Ziihera put the company on the cusp of a major oncology growth phase.

Zen Rating: A (Strong Buy) — see full analysis

Recent Price: $168.94 — get current quote

Max 1-year forecast: $247.00

Why we're watching:

- Analysts love it: Right now, JAZZ enjoys 7 Strong Buy, 3 Buy, and just 1 Hold among the 11 analysts we follow covering the stock. See the ratings

- For example, JP Morgan's Jessica Fye (a top 4% rated analyst) recently maintained her Strong Buy rating with a $199 price target, noting that Jazz's strong fundamentals remain a compelling reason to invest with a focus on delivering shareholder value.

- Piper Sandler's David Amsellem (top 5%) recently reiterated his Strong Buy rating with a $219 price target, continuing to remain bullish on Jazz's growth potential due to its solid pipeline and strategic acquisitions.

- Zen Rating highlights: Despite being in an iffy industry (Biotechs are volatile, y’all), JAZZ earns the highest Zen Rating possible — A (Strong Buy). Stocks in this tier have historically delivered 32.52% annual returns.

- Component Grades: Jazz earns high marks with an A in Value, B in Growth, B in Momentum, B in Safety, B in Financials, and B in AI components, demonstrating balanced strength across multiple dimensions. See all 7 Zen Component Grades here

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.