3 New Strong Buy Ratings from Top-Rated Analysts: 12/17/2024

Analysts are bullish on PTC Therapeutics (NASDAQ: PTCT) due to exciting products in the pipeline, Imax Corp. (NYSE: IMAX) on news of a robust upcoming movie slate, and Micron Technology (NASDAQ: MU) ahead of earnings. All of these stocks also have A or B Zen Ratings, putting them in a class of stocks that have historically outperformed the market.

1- PTC Therapeutics (NASDAQ: PTCT)

This biopharma company focuses on medicines for patients with rare disorders, and boasts a robust pipeline of commercial products and candidates in various stages. Possible approvals on the horizon make this a stock to watch.

Zen Rating: B (BUY) — see full analysis >

Recent Price: $46.37 — get current quote >

Max 1-year forecast: $71.00

Why we’re watching:

- Analyst support: PTCT enjoys a Buy consensus among the 11 analysts we track issuing ratings.

- Notably, Morgan Stanley's Jeffrey Hung recently upgraded their rating on PTCT from Hold to Strong Buy, and raised their price target by 48.9% from $45 to $67.

- Hung expressed optimism about PTC Therapeutics' valuation outlook going into the new year, citing as catalysts "numerous favorable developments."

- The analyst added that the current scenario contrasts with the regulatory challenges the company encountered for almost all of its programs just over a year ago.

- Hung maintained their belief that going into 2025, the possible approval and introduction of sepiapterin by the 7/29 PDUFA date will be one of primary investor interest.

- PTCT also has a B rating (BUY) on our Zen Ratings system, meaning it’s in the top 20% of stocks we track, and in a class with stocks that have consistently delivered double-digit returns for the past 2 decades. (See how we grade stocks here)

- AI algorithms forecast future success: Each stock is graded through 7 Component Grades. PTCT earns an above-average AI rating grade from our advanced AI algorithms that detect subtle patterns in market data and anticipate future trends that point to superior stock price results. (See all 7 Zen Component Grades here >)

–––––––––––––––––––––––––––––––––––

A message from our sponsors...

Start Collecting Your $4,243 Monthly Paycheck Next Week

Just released updated details on a new system for collecting steady dividend income every month. Within a month you could collect $4,243 in extra cash. It's called the Monthly Dividend Paycheck Calendar because if you follow it you'll be sure to get dividend paychecks every month. You need to be enrolled ASAP in order to make sure you're on the list for the first payout.

Thanks to our sponsors for keeping this content free.

–––––––––––––––––––––––––––––––––––

2- Imax Corp. (NYSE: IMAX)

Ever seen an IMAX movie? You have this company to thank. This cinematic solutions provider does more than you might think: It’s pivotal in planning theater design, creating specialized equipment, and more. With substantial leverage in the industry and a robust slate of upcoming movies, it’s on our radar for the foreseeable future.

Zen Rating: B (BUY) — see full analysis >

Recent Price: $26.23 — get current quote >

Max 1-year forecast: $30.00

Why we’re watching:

- Analyst support: Among the 9 analysts we track issuing ratings on IMAX, the stock enjoys a Strong Buy consensus.

- For example, Benchmark's Mike Hickey recently raised their price target on IMAX 11.1% from $27 to $30.

- Factors contributing to Benchmark's continued optimism on Imax's future growth, according to Hickey, include a "robust" film slate, an increasing installation network, and substantial operational leverage.

- Great Zen Rating: Movies have been making a comeback post-pandemic, and IMAX’s above-average Zen Rating of B (Buy) reflects that. Digging deeper, you can see that among the 7 Component Grades that play into that overall rating, IMAX scores high for Safety, meaning it may be suited to more conservative investors. (See all 7 Zen Component Grades here >)

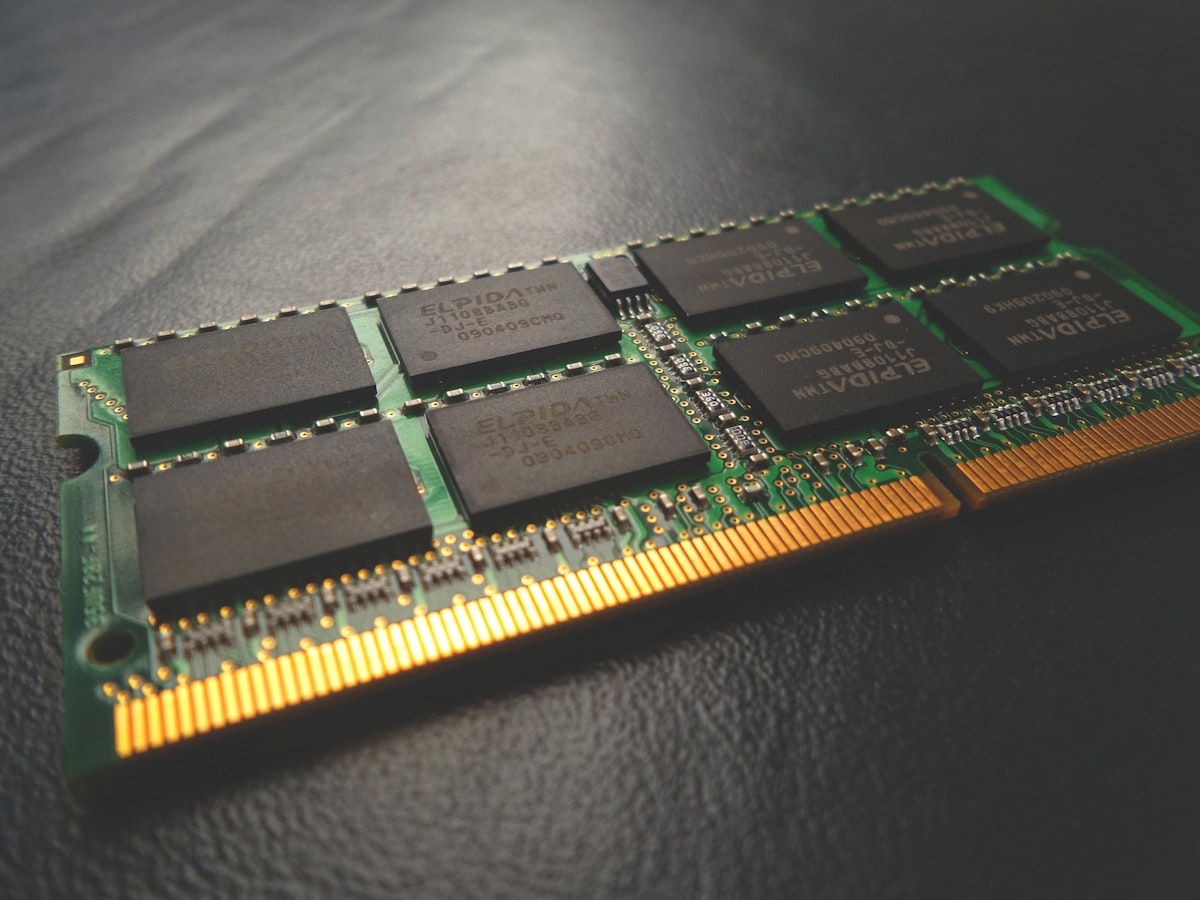

3- Micron Technology (NASDAQ: MU)

Despite a significant dip over the summer, Micron Technology, which designs, manufactures, and sells memory and storage products, has plenty of near-term promise according to analysts. Keep reading to find out why.

Zen Rating: B (BUY) — see full analysis >

Recent Price: $109.93 — get current quote >

Max 1-year forecast: $250.00

Why we’re watching:

- Analyst support: Among the 19 analysts we track issuing ratings on MU, the stock enjoys an impressive Strong Buy rating, with the top 1-year forecast suggesting nearly 150% potential upside.

- Notably, Stifel Nicolaus's Brian Chin recently reiterated their Strong Buy rating on MU and maintained a $135 price target ahead of the company’s 12/18 earnings date.

- The analyst said they expect the print to "largely track" Stifel Nicolaus' and consensus projections, implying robust Q/Q and Y/Y growth.

- Noting that their firm's Q2 2025 below-consensus-estimates assume only "modest" Q/Q improvement, Chin said Stifel Nicolaus believes management might guide "even more conservatively" because of cyclical and seasonal challenges and consumer demand that "continues to underwhelm."

- Nonetheless, the analyst argued that this is "a mid-cycle correction, in which Micron Technology can sustain strong margins/profitability."

- Our proprietary Zen Ratings system, which reviews 115 factors proven to drive stock growth, agrees that MU is potentially portfolio-worthy. The stock enjoys a B (Buy) rating, with above-average trades in two particular areas: Value and Growth. Care to learn more? (See all 7 Zen Component Grades here >)

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.