3 AI Stocks That Could Run Before Christmas

When you’re looking at gold, sometimes it's best to sell shovels. It may also be wise to consider the same approach when investing in AI. Everyone is looking at AI stocks, advanced computer chip stocks, and the like. And many of them are overpriced.

Yet not all of them are. Certainly not all stocks related to the needs of AI are a bad pick, either. There are still plenty of stocks surrounding this tech advancement worth watching. Specifically, look at ones with a Zen Rating of A, which place them in the top 5% of stocks we cover. Stocks with this rating have an average annual return of +32.52%.

A note from our sponsors...

Buffett's $114 Secret In 1943, a teenage Warren Buffett put $114 into a special type of account called "The 29% Account." Today, that single, $114 investment would be worth over $15 million. Your bank never told you about this. Click Here to See How It WorksHere are three related stocks to consider:

1. Genie Energy Ltd (NYSE: GNE)

Selling energy and natural gas to mostly residential and small business clients in the Eastern and Midwestern US, you don’t want to let GNE slip under your radar during the big AI push (which needs a lot of energy). While it’s a bit smaller scale (about a 395.5M market cap) than the giant names in energy, GNE is looking strong for a couple of reasons:

- Demand for energy and electricity isn’t going to go down anytime soon.

- While there was a decline in Q2 earnings year-over-year, and the stock price has been down this year, GNE still has some strong fundamentals.

These factors could make GME a potential hidden gem and worth your attention.

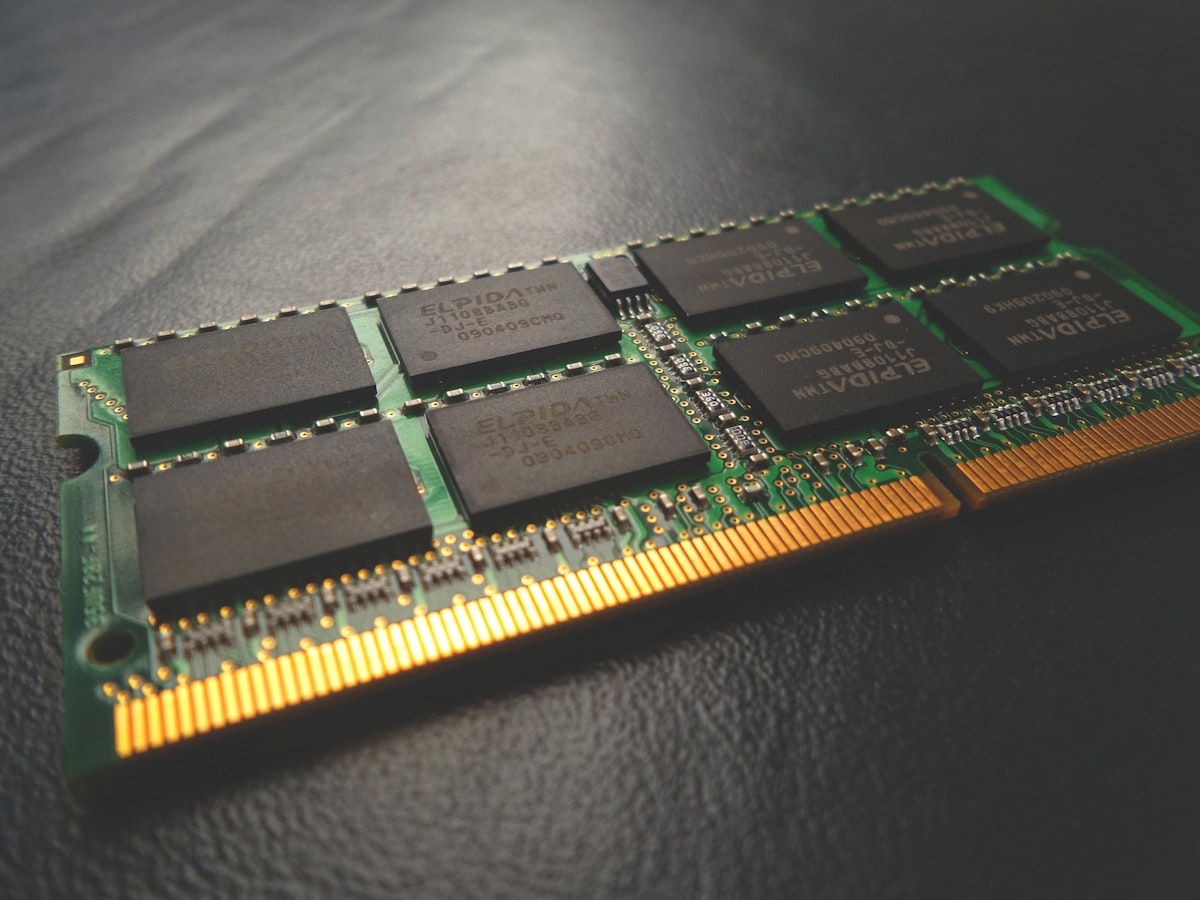

2. Micron Technology (NASDAQ: MU)

There are many companies that are seeing increased demand for their products because of the AI boom, but few look to have as solid fundamentals as MU, which has had a fantastic run over the last year (and beyond), but still has a Component Grade of A for Momentum and B for Value, Financials, and Sentiment. Despite the rise, there are still opportunities with MU.

You will want to keep watch on the demand for their memory and storage products (especially as they relate to data centers). You will also want to monitor how their profit margins evolve over time, whether MU can sustain that demand, and how it will adjust when the AI market shifts (for better or worse).

3. 8x8 Inc (NASDAQ: EGHT)

There are few software companies benefitting from the AI boom as much as EGHT is currently, and the business software solutions company is working on incorporating AI into many of its products. And despite all of this, it still has a Value Component Grade of A, among other strong scores.

Earnings growth potential is also present, and the general client base for EGHT may expand, considering that they provide AI-driven solutions that many companies want to employ to make their operations more efficient.

However, there are plenty more stocks in, around, and outside of the AI sphere that are worth your attention and maybe your investment. It can be hard to keep track of them all. For that, we have WallStreetZen Premium. It will provide you with an unlimited watchlist, all the fundamental information you need to make more intelligent investment decisions, and more. It’s the perfect companion for turbulent markets.

Yet perhaps you would like a more guided approach during these uncertain times. We have you covered there with Zen Investor. With it, you’ll receive regular market commentary from our own Steve Reitmeister, who has more than 40 years of investing experience. You’ll also gain access to a model portfolio hand-selected by him using his experience and the Zen Ratings system, ensuring you get the best of both worlds.

What to Do Next?

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.