Is This Bull Market for Real?

The June financial headlines boasted about record highs for the S&P 500. However, the wider you look…the more anemic those bullish claims appear to be.

This was a central theme discussed in the Zen Investor webinar back on 6/19. (Members can watch it here)

And as I will share in this monthly commentary below…that oddity continued throughout the month…and pretty much is the case year to date as well.

Market Commentary

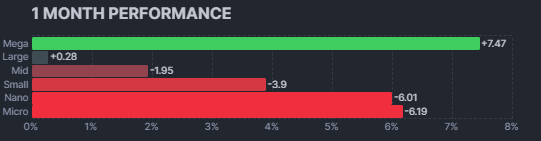

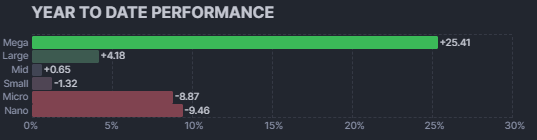

These 2 charts pretty well tell the sad and hollow story about the 2024 bull market:

June 2024 Performance by Market Cap

Year to Date 2024 Performance by Market Cap

Here we find that once again that mega caps like the Magnificent 7 are enjoying all the fun with modest gains to nasty losses for most everyone else. This also points out that the S&P 500 is not a fair benchmark to compare to what the average investor is seeing in their results.

Of course, the first question that comes to mind is: WHY is this happening?

If we take a step back to the “dovish tilt” Fed announcement on November 1, 2023 we see how that promise of future rate cuts led to a broad rally for stocks. Not just the usual suspects in the S&P 500. But all the way down to small caps which actually outperformed by a solid margin over large caps.

That party ended as the calendar flipped to 2024 as there were too many economic reports pointing to inflation not cooling as fast as expected. This led to the Fed to being more patient than investors expected. And thus investment dollars moved more to a “Flight to Quality” profile.

Historically that has meant outperformance for conservative groups like Utilities, Healthcare and Consumer Defensive. Indeed, some of those groups are doing fairly well this year. However, in the modern era the stocks people cling to in tough times are the Magnificent 7.

That is because it is believed that “rain or shine” they will continue to grow and thus a new form of safe haven for investors. And when you look at the earnings growth of companies like NVDA, AMZN, APPL, META etc…you can see there is some truth to this notion.

At this stage the Fed has lowered our expectations saying that likely only 1 rate cut is in the mix for 2024. Interestingly, 4 Fed officials are predicting no cuts this year.

Since that 6/12 announcement the subsequent rounds of economic data have actually been a net positive for the further reduction of inflation while the economy continues to grow.

Especially the better than expected PCE inflation data from last week. This led Powell to say as much at a speech on July 2nd…yet still preaching the need for a bit more patience before cutting rates.

My main point today is that rates will be cut at some point in the future. And likely starting by the end of 2024. This will be a catalyst for the broadening of stock gains as we saw on the big bull run that started November 2023.

This is why I am not loading up on large and mega cap stocks at this time. Because when this rate cut catalyst unfolds, it will last for a long time and likely profits will be trimmed from those overripe groups and rotated to new positions elsewhere.

We want to reside in those high potential “elsewheres” that should outperform in the months and years that follow the rate cuts. Smaller stocks is one such place. As well as Risk On groups like tech and industrials that benefit from improvements in the economy.

This is also a statement that results have been…and will continue to be…lumpy until this rate cut catalyst unfolds. But if you have the right long term vision in mind, it will help you not get to sea sick on the journey that should have us enjoying superior long term gains.

What To Do Next?

Discover my Zen Investor portfolio filled with 9 top stocks with tremendous upside potential.

What these stocks have in common is that each has made it through the gauntlet of our proprietary 4 step process that weeds out weaklings leading to more 100%+ winners.

If you are curious to learn more, and want to see my top 9 stocks, then please click the link below to get started now.

Discover the Zen Investor & Top 9 Stocks

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

Editor of the Zen Investor

Want to get in touch? Email us at news@wallstreetzen.com.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsPerformanceHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.