Intel's Price Target Lowered by Barclays Analyst Amid Pressured Segments

Barclays's Ryan Macwilliams lowered their price target on Intel (NASDAQ: INTC) by 9.1% from $44 to $40 on 2024/04/26. The analyst maintained their Hold rating on the stock.

This adjustment comes after Intel reported its first-quarter 2024 earnings, which exceeded expectations. The company posted earnings per share (EPS) of $0.18, beating the Zacks Consensus Estimate of $0.13. Additionally, Intel's revenue for the quarter reached $12.7 billion, surpassing Q1 2023's figure by 8.5%. Despite these positive results, Macwilliams believes that Intel's Data Center and Client Computing Group segments will continue to face pressure until June 2024. However, the analyst anticipates a rebound in the second half of the year.

Intel's CEO, Pat Gelsinger, expressed confidence in the company's progress and highlighted the strong innovation across its client, edge, and data center portfolios. Gelsinger emphasized the successful production of Intel 3, leading-edge semiconductors manufactured in the U.S. for the first time in nearly a decade. He also mentioned Intel's plans to regain process leadership next year through the growth of Intel Foundry and the acceleration of AI solutions.

In addition to Barclays's Ryan Macwilliams, other analysts have also updated their ratings on Intel since the earnings report. Morgan Stanley's Joseph Moore lowered their price target by 25%, from $48 to $36, and maintained a Hold rating on the stock. Wells Fargo's Aaron Rakers reduced their price target by 11.6%, from $43 to $38, while maintaining a Hold rating. Wedbush's Matt Bryson lowered their price target by 18.8%, from $40 to $32.5, and also maintained a Hold rating.

These analysts' ratings indicate a mixed sentiment towards Intel. According to recent data, 21.7% of top-rated analysts consider INTC a Strong Buy or Buy, while 65.2% see it as a Hold. On the other hand, 13% either recommend or strongly recommend selling the stock.

Looking ahead, analysts forecast that Intel will deliver earnings per share of $1.12 for the upcoming year, representing a 16.8% increase on a year-over-year basis.

Since Intel's latest quarterly report on April 25, the stock price has declined by 9.2%. However, when comparing the stock's performance year-over-year, it has risen by 9.7%. It's worth noting that during this period, Intel is trailing behind the S&P 500, which has experienced a significant increase of 25.7%.

Barclays analyst Ryan Macwilliams, who provided the recent rating update on Intel, is ranked in the top 15% of Wall Street analysts according to WallStreetZen. With an average return of 9.9% and a win rate of 57.4%, Macwilliams specializes in the Communication Services and Technology sectors.

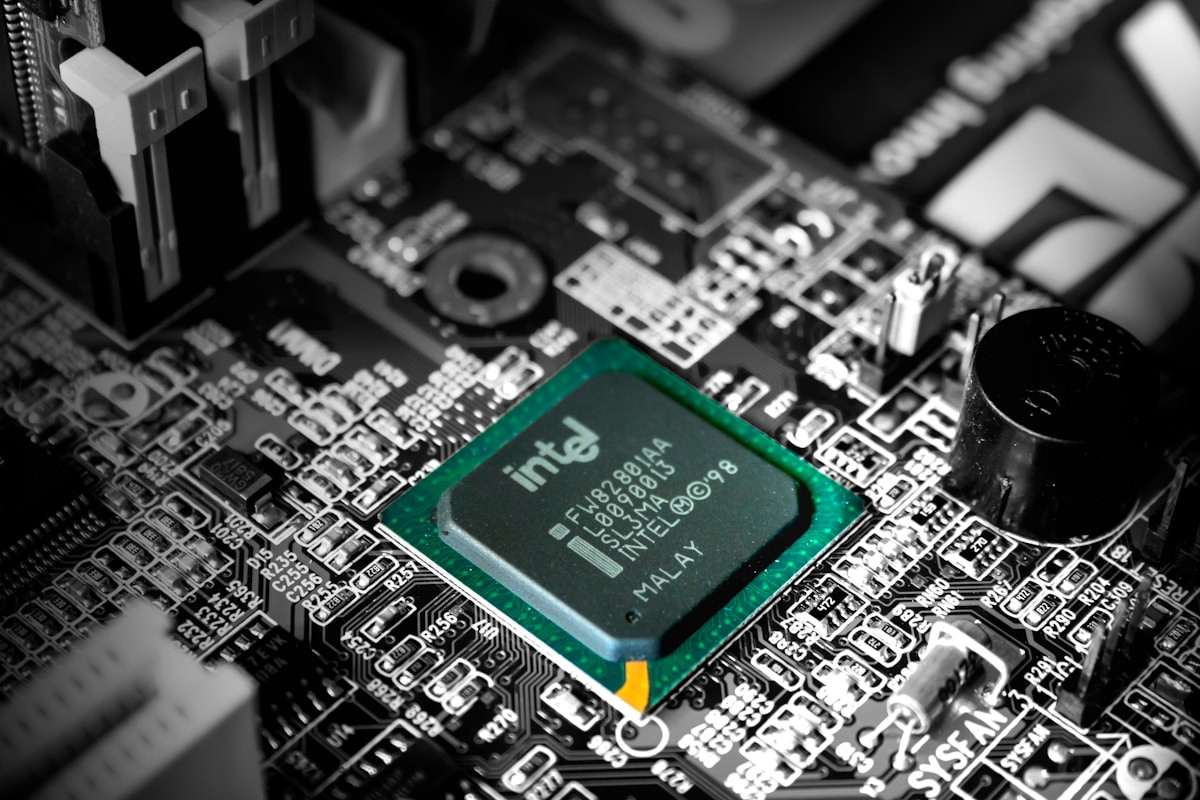

Intel Corporation, headquartered in Santa Clara, California, is a global leader in the design, manufacture, and sale of computer products and technologies. The company operates through various segments, including CCG, DCG, IOTG, Mobileye, NSG, PSG, and All Other. Intel offers a range of platform products, such as central processing units and chipsets, as well as non-platform products including accelerators, connectivity products, and memory and storage products. The company caters to original equipment manufacturers, original design manufacturers, and cloud service providers.

Get free updates on INTC

WallStreetZen tracks the performance of nearly 4,000 Wall Street analysts, whom we rank by average returns, frequency, and win-rate (backtested over multiple years).

Create a free watchlist and be the first to know when top-rated Wall Street analysts revise their Intel stock forecast.

Want to get in touch? Email us at news@wallstreetzen.com.

WallStreetZen and Don Francis do not hold any positions in the companies mentioned in this article. The information and statistics provided herein are presented for general informational purposes only and may not be accurate, complete, or up-to-date. It should not be interpreted as a recommendation to buy or sell any stocks and should not be solely relied upon for making investment decisions. It does not take into account your financial situation or risk profile. All investors should conduct their own investment due diligence before buying a stock. WallStreetZen expressly disclaims any liability for the accuracy, reliability, or completeness of the analysts' information, price targets, ratings, or opinions.

Keep Reading

See All News

Company

AboutNewsBlogStock Investing FAQPlansPrivacy PolicyTerms of ServiceCancellation & RefundsHelp GuidesContactTwitterYouTubeNewsletterInformation is provided 'as-is' and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data.