Companies that mentioned AI saw an average stock price increase of 4.6%, while those who did not only saw a 2.4% increase.

Can the mere mention of ai move stock prices in 2023?

In 2023’s market, the relationship between technological trends and stock market fluctuations has taken center stage. Artificial intelligence's (AI) pervasive presence has proven to have a powerful impact on stock prices — some even refer to the AI boom as a "bubble" and compare it to the dot-com bubble. They claim that merely mentioning AI can cause a rise in the stock price. But is it true? If so, how impactful is the mention of AI on stock price? In this analysis, we’ll explore the topic in detail.

Methodology

We investigated how the mention of the term "AI/artificial intelligence" and AI-similar terms (e.g., machine learning, automation, robots, etc.) in earnings calls affected the stock price of the S&P 500 companies.

Initially, we gathered the quarterly earnings call transcripts for the company from Q1 2022 to Q2 2023 from Motley Fool and Seeking Alpha.

Then, we counted the number of AI mentions in the call, then analyzed each AI-related statement using SentiStrength, a sentiment analysis tool.

From there, we collected the 3-day change in the price of the company's stock, beginning with the date the transcript was released.

Before we proceed with the analysis, please note the following:

- Every price change mentioned in this article is a 3-day change commencing on the date the earnings call transcript was published.

- The companies analyzed in this study are S&P 500 companies.

- All AI mentions used in this article were analyzed from earnings call transcripts.

Key Findings

Companies that mentioned AI saw an average stock price increase of 4.6%, those that did not only saw a 2.4% increase.

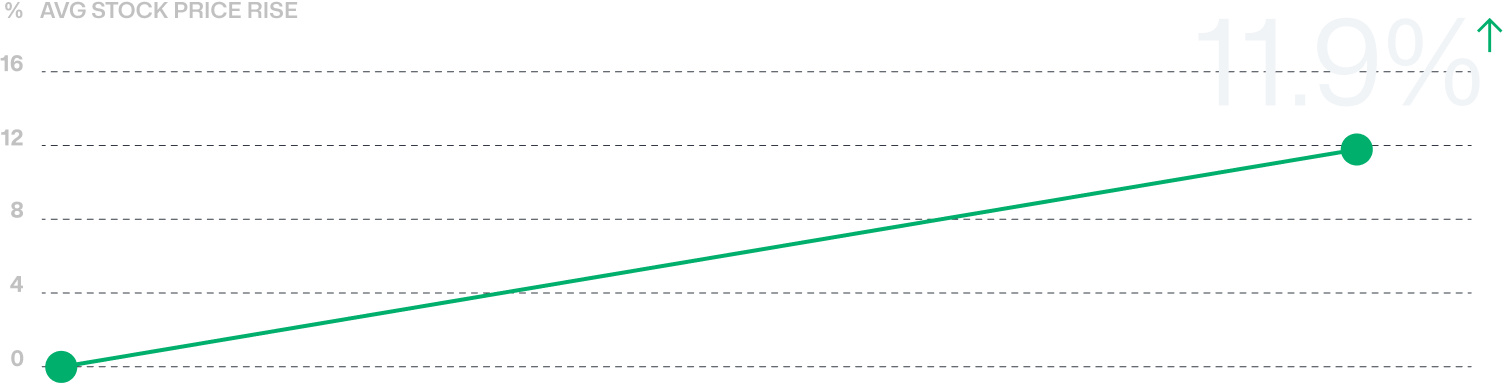

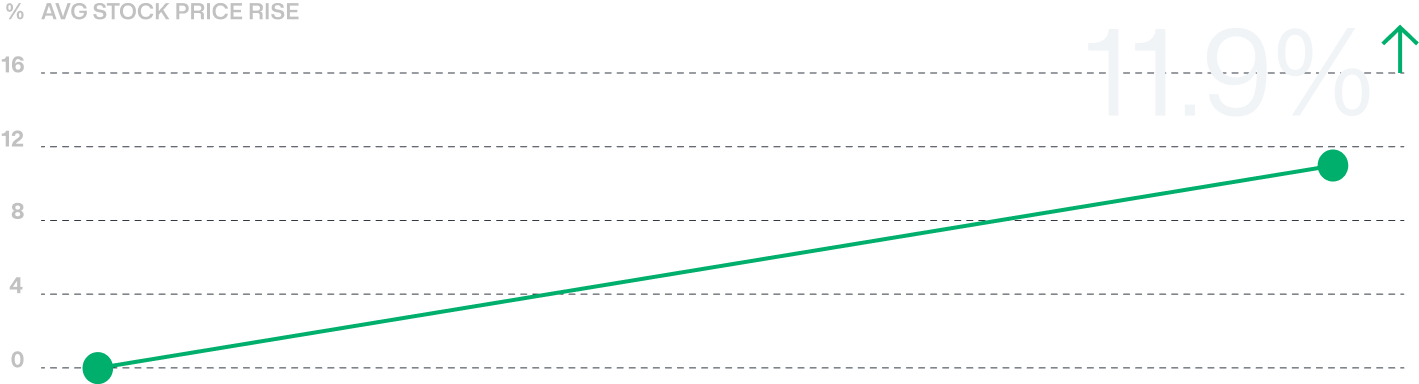

Among technology companies mentioning AI, 71% experienced stock price increases. On average, they rose by 11.9%.

MENTIONING AI IN EARNINGS CALLS — HOW IT AFFECTED S&P 500 COMPANY STOCK PRICES

Among companies mentioning AI, 67% saw a rise.

On average, they rose by

8.5%

71% of technology companies that mentioned AI saw their stock prices rise. On average, they increased by 11.9%.

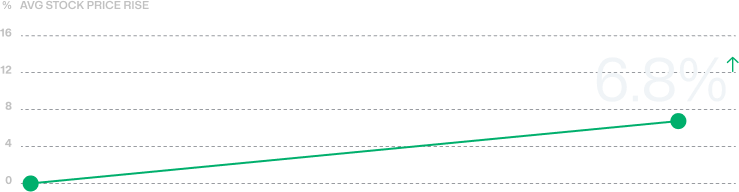

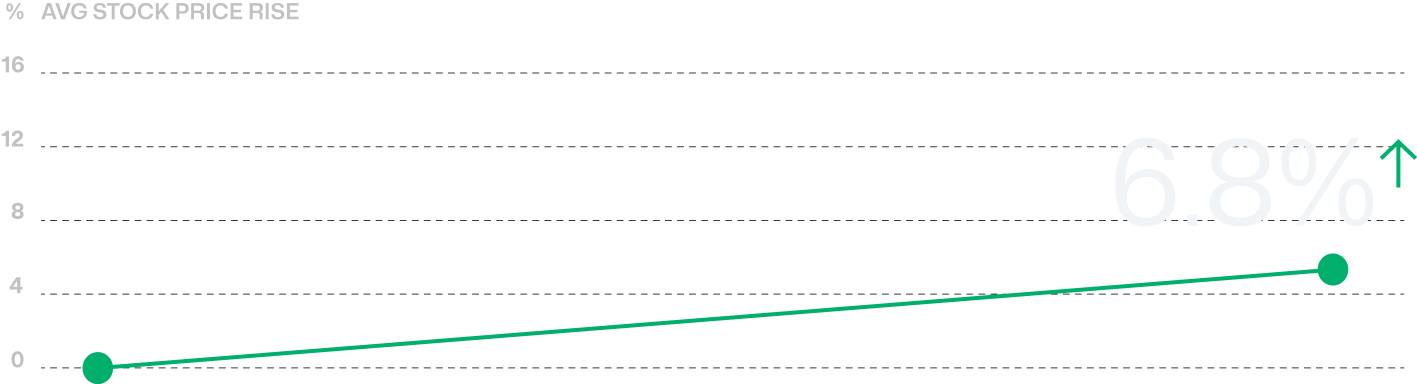

65% of non-tech companies that mentioned AI saw their stock prices rise. On average, they increased by 6.8%.

Among the top 20 companies that grew after mentioning AI, the average stock price increase was 27.5%

| # | Symbol | Company | Sector | Tech/Non-tech | # of AI mentions | 3D Price Change | Sentiment |

|---|---|---|---|---|---|---|---|

| 1 | ADBE | Adobe Inc. | Information Technology | Tech | 33 | 38.2% | ( + ) |

| 2 | CARR | Carrier Global | Industrials | Non-tech | 47 | 38.1% | ( + ) |

| 3 | META | Meta Platforms | Communication Services | Tech | 108 | 37.6% | ( + ) |

| 4 | MTCH | Match Group | Communication Services | Tech | 13 | 37.5% | ( + ) |

| 5 | EXPE | Expedia Group | Consumer Discretionary | Non-tech | 12 | 35.4% | ( + ) |

| 6 | EQT | EQT | Energy | Non-tech | 56 | 32.3% | ( + ) |

| 7 | FTNT | Fortinet | Information Technology | Tech | 2 | 27.5% | ( - ) |

| 8 | MAS | Masco | Industrials | Non-tech | 56 | 27.0% | ( - ) |

| 9 | NVDA | Nvidia | Information Technology | Tech | 150 | 26.3% | ( + ) |

| 10 | MCHP | Microchip Technology | Information Technology | Tech | 75 | 25.9% | ( + ) |

| 11 | AR | Target Corporation | Consumer Staples | Non-tech | 4 | 24.2% | ( + ) |

| 12 | LRCX | Lam Research | Information Technology | Tech | 17 | 23.9% | ( - ) |

| 13 | TTWO | Take-Two Interactive | Communication Services | Non-tech | 15 | 21.4% | ( + ) |

| 14 | FLT | Fleetcor | Financials | Tech | 2 | 21.1% | ( + ) |

| 15 | COP | ConocoPhillips | Energy | Non-tech | 2 | 20.6% | ( + ) |

| 16 | MPWR | Monolithic Power Systems | Information Technology | Tech | 1 | 19.9% | ( - ) |

| 17 | SHW | Sherwin-Williams | Materials | Tech | 66 | 19.9% | ( - ) |

| 18 | UAL | United Airlines Holdings | Industrials | Non-tech | 13 | 19.7% | ( - ) |

| 19 | IQV | IQVIA | Health Care | Tech | 1 | 19.3% | ( - ) |

| 20 | BKR | Baker Hughes | Energy | Non-tech | 2 | 19.1% | ( - ) |

This image is licensed under the Creative Commons Attribution-Share Alike 4.0

International License - www.creativecommons.org/license/by-sa/4.0t

Adobe (ADBE) saw the greatest increase, 38.2%.

Meta (META) and Nvidia (NVDA) share prices increased by 37.6% and 26.3%, respectively. Additionally, these two companies mentioned AI the most among the top 20. On their earnings call, NVDA mentioned AI 150 times; Meta mentioned it 108 times.

Both of them were optimistic about artificial intelligence.

The average decline for the top 20 companies whose stock prices fell the most after mentioning artificial intelligence was 9.6%

| # | Symbol | Company | Sector | Tech/Non-tech | # of AI mentions | 3D Price Change | Sentiment |

|---|---|---|---|---|---|---|---|

| 1 | EL | Estée Lauder Companies (The) | Consumer Staples | Non-tech | 1 | -17.1% | ( + ) |

| 2 | ANET | Arista Networks | Information Technology | Tech | 52 | -15.5% | ( + ) |

| 3 | MKTX | MarketAxess | Financials | Non-tech | 5 | -15.4% | ( - ) |

| 4 | MRNA | Moderna | Health Care | Non-tech | 4 | -15.2% | ( - ) |

| 5 | PYPL | PayPal | Financials | Non-tech | 12 | -15.0% | ( + ) |

| 6 | NDAQ | Nasdaq, Inc. | Financials | Non-tech | 18 | -12.4% | ( + ) |

| 7 | HSY | Hershey's | Consumer Staples | Non-tech | 88 | -11.2% | ( - ) |

| 8 | AXON | Axon Enterprise | Industrials | Tech | 3 | -11.2% | ( + ) |

| 9 | KHC | Kraft Heinz | Consumer Staples | Non-tech | 1 | -10.9% | ( + ) |

| 10 | URI | United Rentals | Industrials | Non-tech | 25 | -9.2% | ( - ) |

| 11 | CAG | Conagra Brands | Consumer Staples | Non-tech | 2 | -8.3% | ( + ) |

| 12 | AEP | American Electric Power | Utilities | Non-tech | 44 | -8.1% | ( + ) |

| 13 | GPC | Genuine Parts Company | Consumer Discretionary | Non-tech | 1 | -7.0% | ( - ) |

| 14 | INTU | Intuit | Information Technology | Tech | 51 | -7.0% | ( + ) |

| 15 | LW | Lamb Weston | Consumer Staples | Non-tech | 104 | -6.4% | ( + ) |

| 16 | DGX | Quest Diagnostics | Health Care | Non-tech | 94 | -6.2% | ( - ) |

| 17 | ILMN | Illumina | Health Care | Tech | 18 | -6.0% | ( - ) |

| 18 | JNPR | Juniper Networks | Information Technology | Tech | 105 | -6.0% | ( + ) |

| 19 | PAYC | Paycom | Information Technology | Tech | 4 | -5.6% | ( + ) |

| 20 | NCLH | Norwegian Cruise Line Holdings | Consumer Discretionary | Non-tech | 2 | -5.4% | ( + ) |

This image is licensed under the Creative Commons Attribution-Share Alike 4.0

International License - www.creativecommons.org/license/by-sa/4.0t

The share price of Estée Lauder (EL) fell the most. The decline was 17.1%. AI was only mentioned once by the corporation.

Two major financial companies, PayPal (PYPL) and Nasdaq, Inc. (NDAQ), saw their stock prices decline after discussing AI in their earnings calls, despite being optimistic about the technology. The respective declines for these two were 15% and 12.4%.

AI mentions skyrocketed in 2023

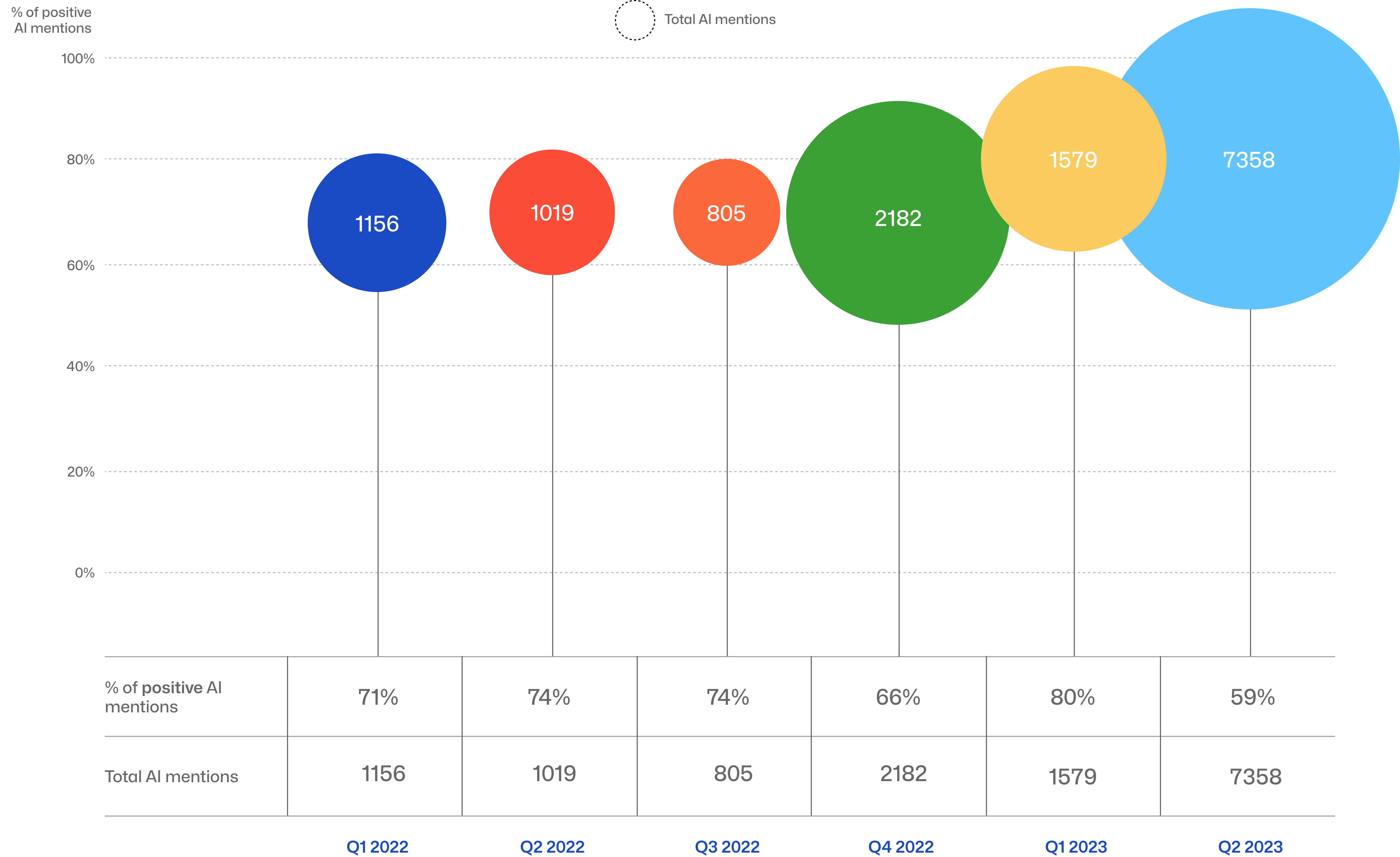

From this, we can see:

- In the fourth quarter of 2022, the number of AI mentions increased by 171% compared to the third quarter.

- The number of AI mentions in Q2 2023 reached an all-time high of 7358, an increase of 366% compared to Q1 2023.

- However, in the first quarter of 2023, 80% of all AI-related mentions were positive, compared to 59% in the second quarter.

Q3 2023 UPDATES

From November 24th to November 28th, we used the same method to analyze the impacts of AI mentions on stock price. Here are what we found:

U.S. companies continue to believe

in artificial intelligence

The number of AI mentions in Q3 2023 reached an all-time high of 8304, an increase of 13% compared to Q2 2023.

58% of AI-related mentions are positive, which is essentially unchanged from Q2 2023.

The diminishing effects of AI mentions

on the value of stocks

Q2

- Among companies mentioning AI,

67% saw a rise. - On average, they rose by 8.5%

71% of technology companies that

mentioned AI saw their stock prices rise

65% of non-tech companies that

mentioned AI saw their stock prices rise

Q3

- Among companies mentioning AI,

52% saw a rise. - On average, they rose by 8.7%

55% of technology companies

saw their stock prices rise

51% of non-tech companies that talked

about AI saw a stock price increase

The average stock price increase for companies that mentioned AI in Q3 was 1.9%. That is a 40% reduction compared to Q2 2023.

In Q3, fewer stock prices were positively impacted by AI mentions:

- Of the companies that talked about AI, more than half (52%) saw an increase. In Q2, that number rose to two-thirds (67%).

- Only 55% of technology companies saw their stock prices rise, down from 71% the previous quarter.

- 51% of non-tech companies that talked about AI saw a stock price increase, which was 14% lower than in Q2.

However, for companies whose share prices went up after talking about AI, the effect on prices stayed pretty much the same:

- Following the mention of AI in Q3, share prices increased by 8.7%, whereas they rose by 8.5% in Q2.

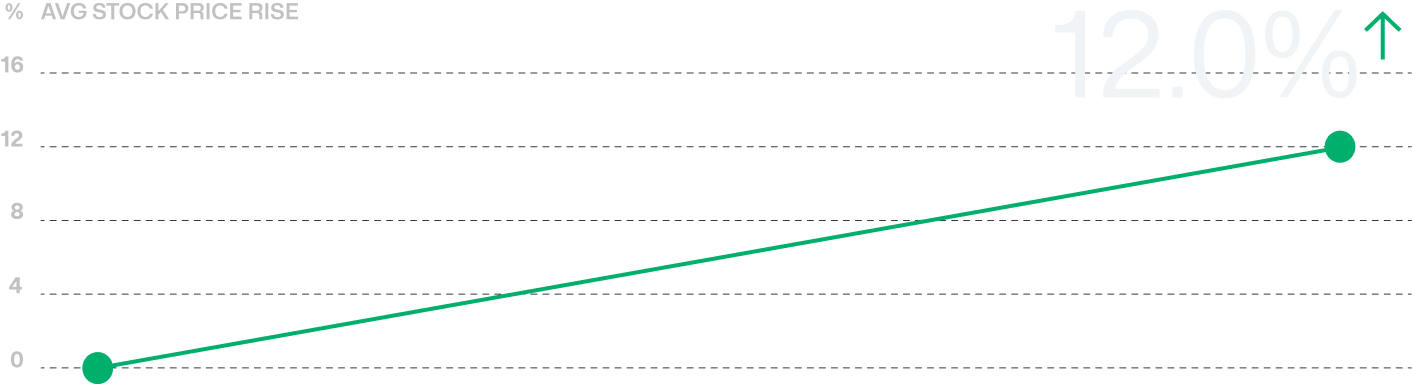

- 12% was the increase for technology corporations in Q3, which is identical to Q2.

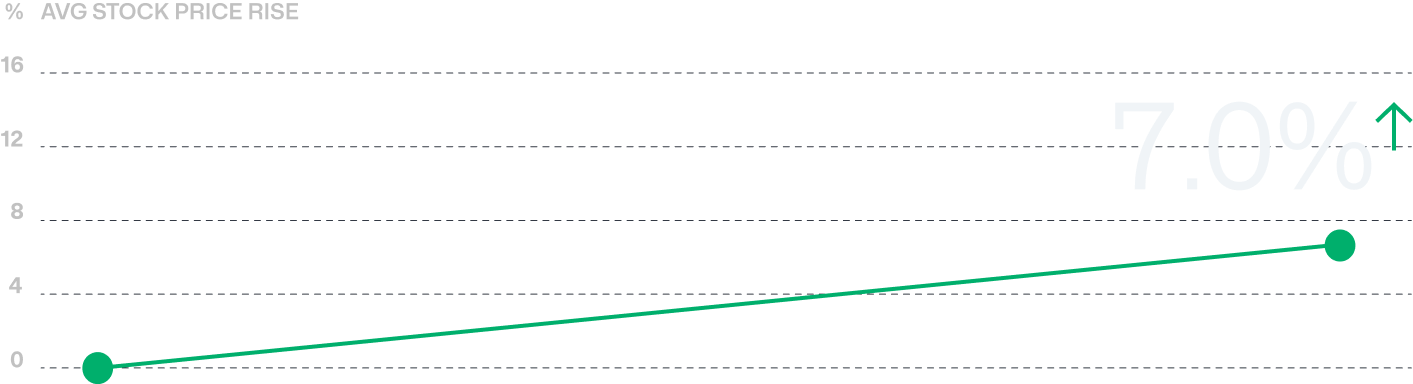

- The percentage increase for non-tech companies has remained almost unchanged at 7% verus 6.8% in the preceding quarter.

Companies MOST IMPACTED BY AI MENTIONS

in the third quarter of 2023

Meta and Nvidia remain the two companies making the greatest number of AI-related mentions. Moreover, these two continue to rank first in terms of gains following AI mentions. Their gains are even greater than those of Q2. More specifically:

Meta (META) and Nvidia (NVDA) share prices increased by 40.6% and 37.3%, respectively. On their earnings call, NVDA mentioned AI 150 times, and Meta mentioned it 108 times. Both of them were optimistic about artificial intelligence.

Meanwhile, among the top 20 companies whose stock prices fell the most after mentioning AI:

Despite 124 positive mentions of AI, Alphabet Inc. share price fell 11.4%.

Analog Devices saw the biggest drop of 17.2% after mentioning AI 12 times.

FINAL WORDS

And with that, we conclude our analysis. Time will tell if the AI boom is a bubble. In the meantime, we will continue to monitor this trend.

If you know someone who could benefit from our findings, feel free to share this report with them. Use of the graphics and content is permitted for non-commercial purposes. Our only request is that you provide a link back to this page so that readers have access to all relevant information and our contributors are duly credited.